Why is Richmond's car tax so much higher than the counties’?

Richmonders pay by far the most in the region to own a vehicle. That’s because the city uses a relatively generous valuation method, provides the lowest rate of car-tax relief and tacks on the region’s highest annual registration fee.

Consider the cost this year of owning the same model – a 2015 Toyota Prius – in Richmond City and three neighboring counties.

This year, city residents will pay $309 in taxes and fees, compared to $209 in Hanover County, $188 in Chesterfield County and $183 in Henrico County. Richmond tax payments are due this Thursday.

Source: Finance officials from each locality. Dollar amounts include both car tax and local vehicle registration fees for a 2015 5D Prius 2. Note: The figure for Hanover is the bill issued in November 2024.Reason 1: Higher tax rate

How do you explain the difference? For starters, Richmond has the highest tax rate (3.70%) in the region.

Car Tax Per $100 of Value

But the tax rate is only one of four factors that go into calculating car taxes and fees.

Reason 2: Car value methodology

All four localities rely on data from the same firm, J.D. Power and Associates, to assess the value of used vehicles. But there are several ways to measure a vehicle’s value – wholesale value, loan value or retail value.

Richmond and Hanover use what is known as the “clean trade value” – the amount someone could expect to receive for a model with expected mileage and good condition when buying a new car. The value is generally higher than the “loan value” used by Henrico and Chesterfield.

Assessed Value of 2015 Prius

Hanover and Richmond: $9,300

Chesterfield and Henrico: $8,375

Source: J.D. Power & Associates pricing guide as of 1/1/2025.

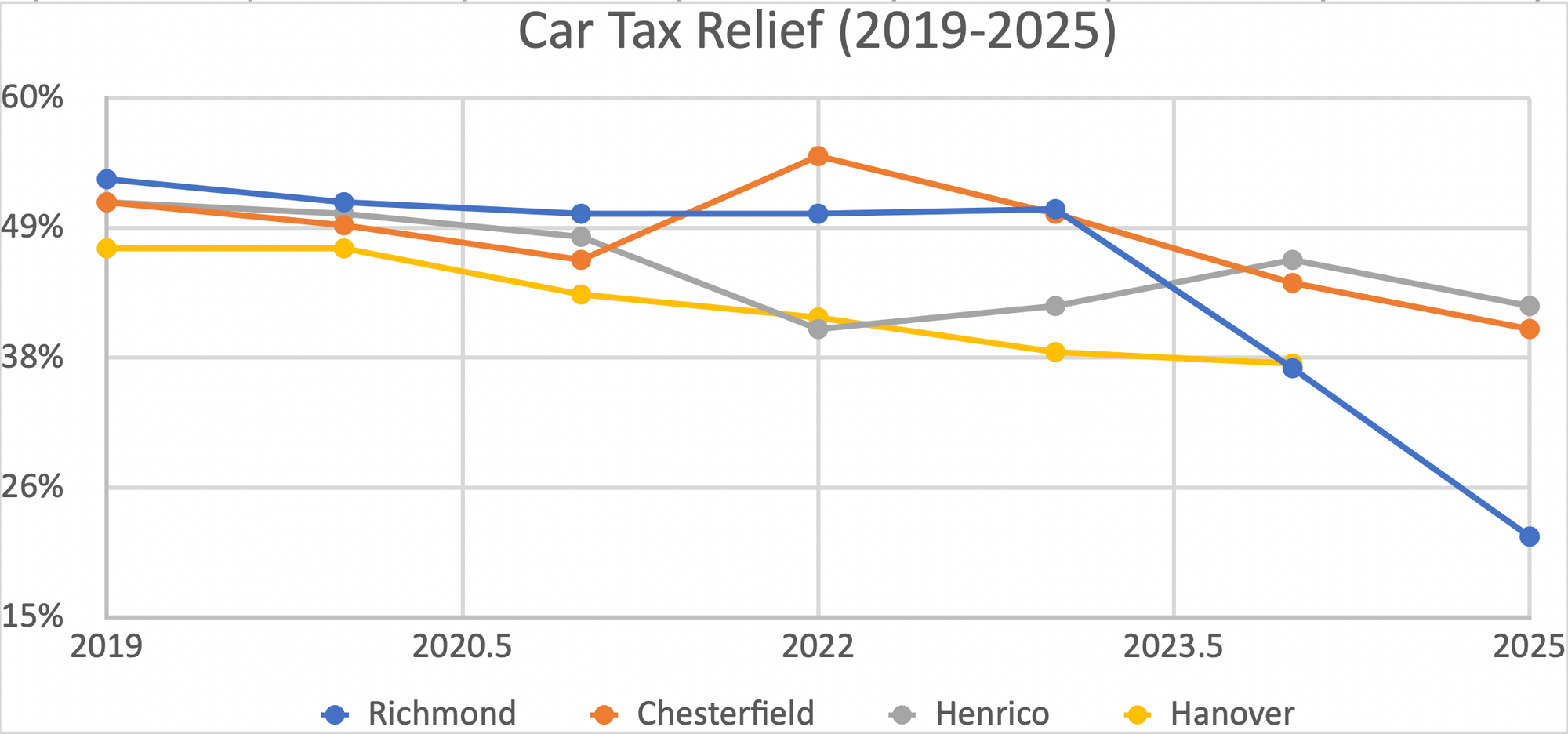

Reason 3: Car tax relief

This is where a calculator and a basic understanding of recent Virginia political history come in handy.

Those who were around since 1997 can recall Gov. Jim Gilmore’s “no car tax” campaign promise.

“It was a brilliant political idea, but a disaster of a financial idea,” said Ann Burkholder, the Commissioner of the Revenue for Winchester and immediate past president of the commissioners’ association.

As the General Assembly sought to phase out the local levy on vehicles, cities and counties demanded the state make them whole for the lost revenue, which was estimated to top more than $1 billion.

The state provided enough money to pick up about 70% of the car tax bill statewide, but the reimbursements proved to be a state budget-buster. Two decades ago, the legislature froze the cost of car tax relief at $950 million a year.

In 2022, counties in the Richmond region dialed back their car tax formulas and supplemented relief with local revenue so taxpayers would not be soaked from an unexpected increase in the value of used cars. Mayor Levar Stoney issued his own tax relief measure that he called a “stair step” approach that froze car tax relief at 50.4% for bills mailed in 2023.

The administration estimated the city’s car tax relief could fall to 40.4% for bills mailed in 2024 and to 30.4% for bills mailed in 2025. It was an attempt to balance two seemingly irreconcilable goals – “protecting the city’s general fund revenue” while “reducing the impact” on taxpayers.

Taxpayers saw the percentage of car tax relief fall farther than city officials had estimated. The car tax bills mailed in 2024 set tax relief at 36.6%.

So far, the city has met its goal of protecting revenue. In the budget year ending June 30, the city reported that money raised from the personal property levy rose 11%, from $59.5 million to $66 million. That was $10 million more than the city had budgeted.

But city vehicle owners have seen car tax relief drop – and their tax bills rise – faster than the Stoney administration estimated. The rate of relief fell to 37% last year and to 22% in bills mailed this year.

The result is that Richmond’s car tax relief rate has eroded the fastest in the region. Other localities are more generous – 42% in Henrico, 40% in Chesterfield and 37% in Hanover.

In total, City residents who own a 2015 Prius pay 28% more in car taxes than owners of the same model in Hanover, 59% more than in Chesterfield and 65% more than in Henrico.

Car Tax Calculation – 2015 Prius

Reason 4: Local Registration Fees

The legislature also allows localities to charge an annual local registration fee. This is also an area where Richmond also leads the pack. The Prius would be charged $40.74 in the city, a little more than twice the flat $20 fee in Chesterfield and Henrico. Hanover does not charge a local vehicle registration fee.

Annual Car License Fee – 2015 Prius

Richmond: $40.74

Chesterfield: $20.00

Henrico: $20.00

Hanover: $0

Source: Information provided by each locality. The fee in Henrico is $25 for vehicles over 4,000 pounds.

The bottom line

Richmond taxes cars at the highest rate in the region, uses the most generous metric when it comes to valuing cars, provides the most meager tax relief and has a annual car license fee that is twice that of any of its neighbors. For all these reasons, Richmonders pay a premium in local taxes and fees to own a vehicle.

The Richmonder is powered by your donations. For just $9.99 a month, you can join the 1,000+ donors who are keeping quality local journalism alive in Richmond.