Testy council meeting ends with no action on tax rate, at Stoney administration's request

A Richmond City Council committee chose not to take action on a pair of competing proposals on the city’s real estate tax rate Thursday after Mayor Levar Stoney’s administration said it needed more time to study the issue.

The Stoney administration requested a delay to review the fiscal impact of keeping the rate at $1.20 per $100 of assessed value or lowering it to $1.16, the two proposals that were on the table for council consideration. Officials also said they wanted to study alternative tax relief proposals that could be targeted toward elderly and low-income homeowners without reducing the rate for every property.

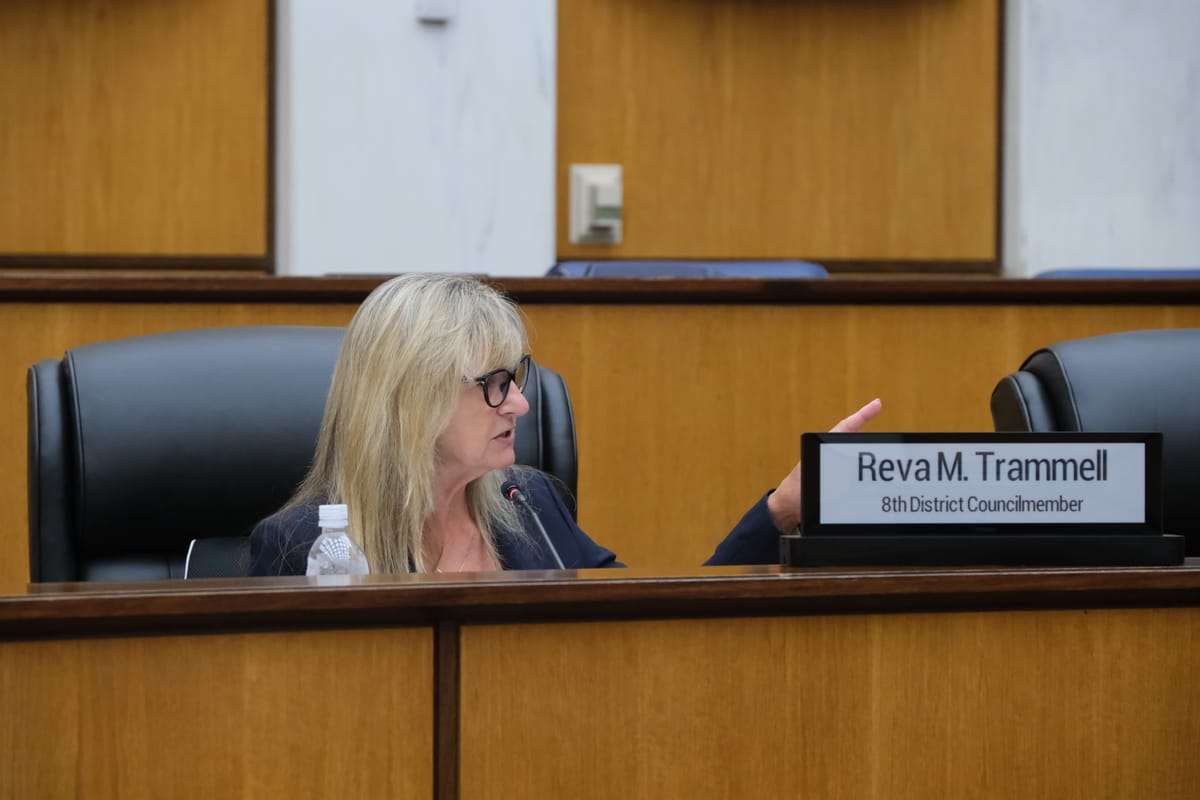

The committee’s inaction infuriated City Councilor Reva Trammell (8th District). She had proposed lowering the tax rate by 4 cents, a plan that could potentially reduce the average residential tax bill by $150 next year.

“We knew this was coming up. But you all knew that you had your minds made up what you were going to do and how you were going to do it,” Trammell said of the two ordinances that were scheduled to be taken up Thursday by the council’s Finance and Economic Development Standing Committee. “You don’t know how bad the people are hurting.”

Trammell’s comments drew a sharp rebuke from City Councilor Cynthia Newbille (7th District), who chairs the finance committee.

“Yes we do, Ms. Trammell,” Newbille said. “You are not the only one who has a sense of the citizenry.”

City Hall had nearly two weeks to prepare for council deliberations on the tax rate. The two proposals were introduced last Monday.

It wasn’t immediately clear when the proposals will be considered, but officials discussed the possibility of hearing them in October or potentially after the Nov. 5 elections.

‘You’re in charge of finance’

Trammell said her plan would give some help to homeowners struggling to pay tax bills that have rapidly increased due to Richmond’s hot real estate market and the rising property assessments the city uses to calculate tax bills.

“‘Every year we talk about how we’re going to do something for the citizens. And this is what we get,” Trammell said to Newbille. “You’re in charge of finance.”

During a public comment period, a few speakers urged the council to support Trammell’s proposal.

“For most people, you’re paying 40% more in taxes,” said Johnny Walker, a former 4th District City Council candidate. “And that’s just not right.”

Paul Goldman, an attorney and activist who has sparred with the Stoney administration and is now running for City Council in the 1st District, said Richmond voters are expecting “the cost of government to go down.”

“And they’ll be disappointed if it doesn’t,” he said. “Because it’s your obligation to do it.”

Administration officials asked for a delay so they could look at the potential “revenue loss” from lowering the tax rate and explore ways to give tax relief only to property owners truly in need of financial assistance.

“We think targeted relief will be able to do more for those who need it most,” said Chief Administrative Officer Lincoln Saunders.

Saunders pulled Trammell aside for a private conversation prior to the meeting, but the apparent attempts to explain why her tax relief plan wouldn’t be considered didn’t seem to work.

“This is more important than anything on your damn agenda,” Trammell said as Newbille tried to move on to other business.

Councilor Andreas Addison (1st District) tried to cut through the raised voices with a proposal of his own.

If the city ran a budget surplus in the fiscal year that ended June 30, he said, the council should explore a tax rebate or refund. He noted that real estate tax assessments just went up by nearly 6.7%, a higher jump than the 4% growth the city budget anticipated. After the Federal Reserve’s decision to cut interest rates this week, Addison said, Richmond’s real estate market will probably only get hotter.

“We are going to continue the trend of pushing people out of their homes,” Addison said. “This is the biggest thing I see happening across every district in our city right now.”

Addison, who is running for mayor this year, said the council should leave the issue of adjusting the tax rate to the mayor and City Council that voters will elect in November.

Stoney has said Trammell’s tax proposal would cost the city about $16 million in foregone revenue. However, the actual impact on the budget would be smaller given the extra money the city will collect from rising real estate assessments.

City officials told The Richmonder that adopting a $1.16 rate would reduce the current budget by about $3.2 million, according to “preliminary estimates.”

That could require cost-saving measures like leaving vacant positions unfilled, but it’s unclear if it would create a major hole in the budget given the steady growth in real estate revenues.

On a bulletin board at City Hall where officials post legally required notices, Trammell’s proposal is advertised as a “real property tax increase” because it would still lead to homeowners paying higher bills than they did the year before. With a $1.16 rate, the city’s current budget would be 3.6% larger than the previous budget, according to that notice.

If the tax rate were kept at $1.20, the city’s budget would grow 5.2% over the previous year.

‘The more challenging calculation’

A state law meant to keep local property tax bills relatively stable from year to year requires the city to consider rolling back its tax rate if assessments increase by more than 1%. That law is the reason the City Council now has to take a public vote on the tax rate after new assessment notices were sent to property owners this month showing growth above 1%.

When asked by The Richmonder why the Stoney administration didn’t have fiscal impact estimates available for Thursday’s meeting, Saunders said he and his team weren’t just crunching the numbers for the current budget. He said they’re also looking at how a rate reduction would impact long-term spending obligations.

“It also includes our collective bargaining agreements, where the city has committed to certain wage increases and investments in our personnel that are now a contractual agreement,” Saunders said. “The impact to our ability to fund those over the next four or five fiscal years is the more challenging calculation. This paper was introduced a week and a half ago.”

Saunders said the administration shares concerns about homeowners being displaced by rising tax bills, but is pursuing more targeted ways to address that issue that don’t involve lower taxes across the board.

Roughly two-thirds of the tax relief that would occur under Trammell’s plan, he said, would go to the top 20% of property owners.

“We believe that through some of the options that we’re preparing to bring forward, through that targeted relief, we can make the most impact to curb the displacement, the pushing out of residents,” Saunders said.