Now’s not the time to cut Richmond’s property taxes, Avula says

As Richmond property owners absorb another round of higher tax assessments, city officials are restarting the annual debate over whether they can or can’t afford to lighten the burden on taxpayers.

At least three City Council members are backing a tax relief proposal that would cut around $160 off the yearly tax bill for a typical home valued at $400,000. But Mayor Danny Avula said Tuesday that he can’t support that plan that would cost the city $16.8 million in foregone revenue at a time of pressing needs.

“This does not feel like the best time to actually pull back on the revenues that are available to us as we're trying to improve service delivery to our residents,” Avula said at a City Hall news conference Tuesday.

Avula noted that people with the most expensive homes would get the most benefit from a lower tax rate, and questioned whether a few hundred dollars per year would make a significant difference to the finances of many Richmonders.

“For some people, it does. For many people, it won't,” Avula said. “And the collective impact of that is really significant on our city budget. This is a city where we do have growing investment needs in schools, in infrastructure.”

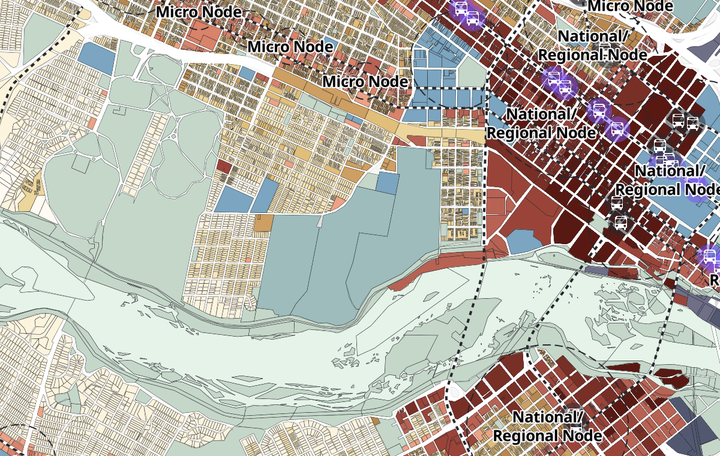

Because of Richmond’s hot housing market, homeowners have faced steadily rising tax bills as the assessed value of their property increases year after year. When there’s strong growth in assessments, Virginia law requires city officials to consider rolling back the tax rate to shield residents from what’s effectively a subtle tax increase.

Richmond leaders have routinely chosen not to reduce the rate, choosing to leave it unchanged at $1.20 per $100 of assessed value. Though the rate has stayed the same, rising assessments have led to a significant bump in tax money the city collects.

In fiscal year 2020, the city took in a little more than $300 million in real estate tax revenue. After citywide assessments rose by 5.74% this year, the city expects to take in about $523 million in real estate taxes for the current budget year.

The budget growth occurred as rising inflation and the adoption of collective bargaining for city employees also drove up government costs.

Council members who support lowering tax bills argue the city has enough money to give residents a break.

“With all the money that’s being wasted at City Hall, you say you don’t have it?” Councilor Reva Trammell (8th District) said in an interview. “You do have it. We can do this.”

Trammell, who represents a high-poverty South Richmond district, said she doesn’t care about the argument that well-off Richmonders would benefit most from an across-the-board tax cut.

“You want to know why? They pay their fair share,” she said. “They don’t mind helping. They don’t mind giving. God help us if they all decide to move to Chesterfield.”

The Council has to hold a public hearing and vote on whether to keep the rate as is or roll it back under a formula laid out in state law that aims to keep tax bills mostly steady from year to year.

Trammell is backing a four-cent reduction in the rate to $1.16 per $100 of value, which is a little higher than the $1.146 rate the city would adopt if it were to fully align with the state rollback formula.

Councilors Sarah Abubaker (4th District) and Stephanie Lynch (5th District) have also signed on as supporters of the $1.16 rate.

“I’m trying to champion protecting the taxpayer and particularly our long-term residents of the city of Richmond,” Abubaker said in an interview. “I just don’t think we’ve done a very good job as a city of showing that we’re good stewards and we deserve that additional tax revenue.”

The Council is set to begin its discussions on the tax rate Wednesday afternoon at a meeting of its Finance and Economic Development Committee, when two competing ordinances are on the agenda to adopt a rate of either $1.20 or $1.16.

The Richmonder is powered by your donations. For just $9.99 a month, you can join the 1,000+ donors who are keeping quality local journalism alive in Richmond.

The full Council is expected to vote on the matter later this fall, but the exact timing could depend on how much fiscal research members want to do before making a decision. In the same situation last year, the Council delayed a vote on the tax rate several times.

The mayor said the city is in a particularly delicate situation this year, facing both federal budget cuts and an upcoming one-year assessment freeze that will prevent the city from seeing the same type of year-over-year revenue growth it’s seen recently.

The city won’t send out new assessment notices next September, which means taxpayers’ bills will stay the same for two cycles. The next reassessment notices won’t go out until early 2027, synchronizing the timeline with the city’s budget process and giving officials more power to pass a budget based on actual real estate revenues instead of estimated numbers.

Depending on what happens with the housing market, in 2027 homeowners could see higher-than-normal increases in their property values, with two years’ of value increases hitting at once to make up for the frozen year.

Last year, former Mayor Levar Stoney’s administration offered one-time tax rebate checks as an alternative to lowering the rate. After some technical problems, those checks went out to taxpayers this summer.

The Avula administration hasn’t proposed a similar rebate this year.

Avula said he’s open to lowering the rate once the freeze is complete if he determines the city can absorb the reduction in revenue. With his relatively new administrative team in place, the mayor said, work is underway to fully assess how the city collects and spends taxpayers’ money.

Whether tax relief happens in Avula’s four-year term, he said, could come down to how much of a “pain point” real estate taxes are for residents.

“No matter what, we are going to come to a question at some point of… does whatever money we would save from a tax cut, is that a better and higher use than something else we might put it into,” Avula said. “And that's a question that has to be played out in the public. That’s where our democracy leans in and says either ‘yes it is’ or ‘no it isn’t.’ And the City Council would be the conduits of that decision.”

Contact Reporter Graham Moomaw at gmoomaw@richmonder.org